In the modern classroom, traditional methods of teaching are evolving to better prepare students for real-world challenges. One innovative approach recently adopted in our Economics Personal Finance (ECON) class is the use of a virtual business simulation, or career project on the platform “Knowledge Matters.” This simulation provides students with hands-on experience in managing decisions, and though it comes with its own set of challenges, it offers invaluable lessons that extend beyond textbooks.

The simulation is designed to mirror real-world complexities, including managing expenses, maintaining health, balancing a schedule and even the purpose of acquiring insurance for your personal property. Although the stakes in the simulation are lower compared to actual life/business management, the experience is instrumental in illustrating the multifaceted nature of real-world scenarios.

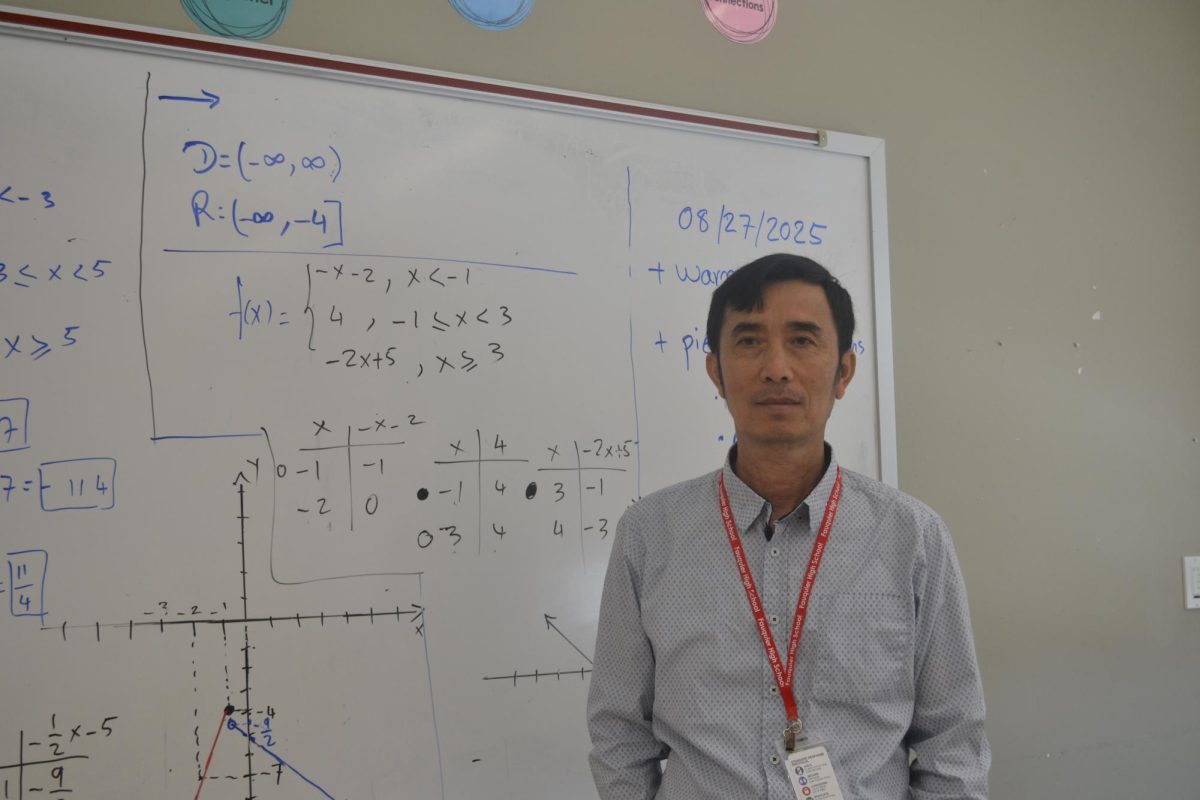

Vocational Business/Marketing Teacher, Frank Strano enjoys teaching personal finance because “It can make a difference in someone’s life.” He believes that “it’s not just teaching a class for the sake of teaching, it’s teaching a class for the sake of … better … [financial] … decisions in the future.”

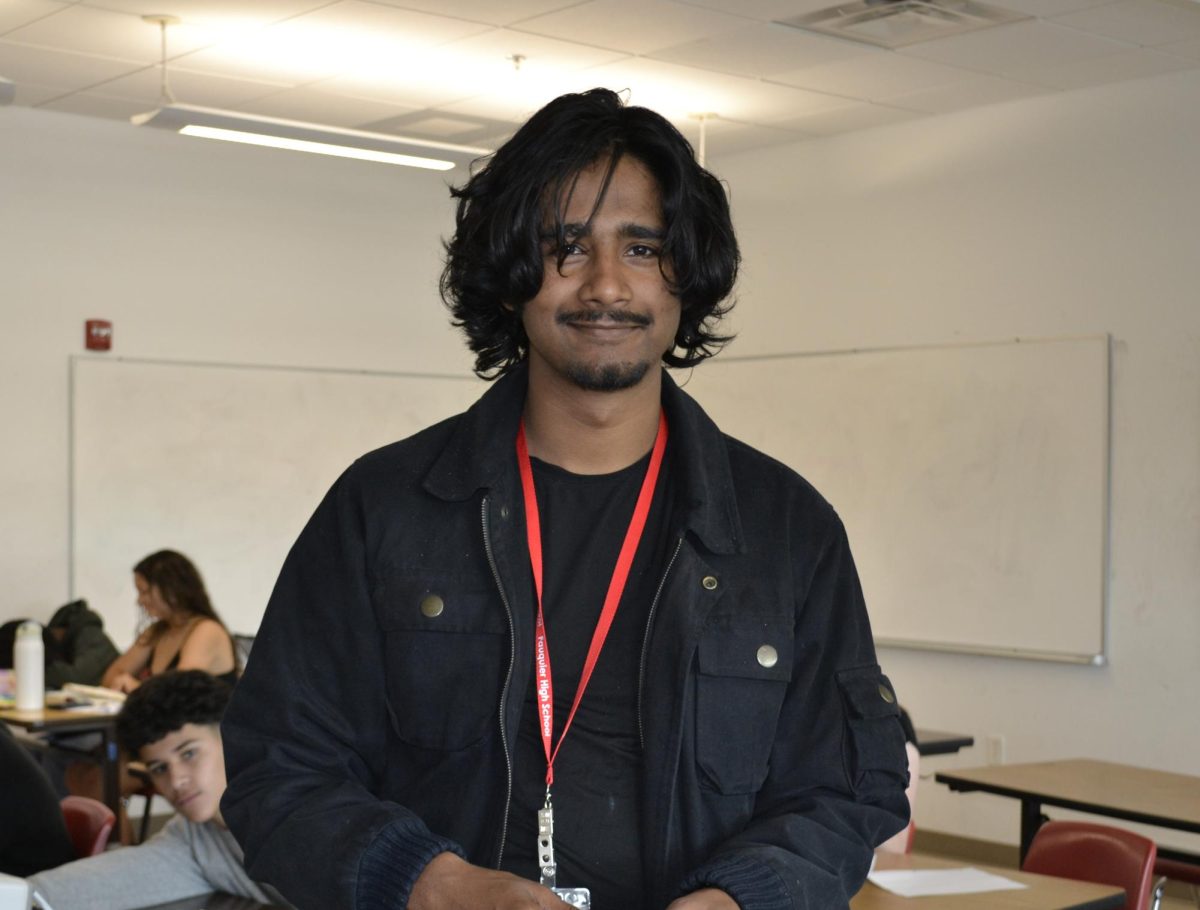

The program exposes students to practical skills they will encounter in their future careers and daily lives. For instance, students must learn to budget effectively, schedule their time and prioritize their health—skills that are crucial in adulthood. Senior, Micheal McCauliff believes that the “time-management aspect of [the simulation]…was…most beneficial.” By navigating these elements, high school graduates gain a deeper understanding of coordinating time, finances and personal well-being. The challenges faced in the simulation, such as balancing expenses with income and managing unexpected setbacks, closely resemble those encountered in real-life situations.

One of the most significant benefits of the simulation is its ability to teach students about resilience. The ups and downs experienced in the virtual environment help students understand that not everything will go according to plan. Although, there are still some twinges in the “general coding,” says Senior Madelyn [Mac] Longoria, “it is easy to work around.” Strano addresses this: “We’ve had some technical challenges, but we usually work them out directly with Knowledge Matters.” He attributes the difficulties students face in Knowledge Matters to the fact that it is “constantly being updated. They’re [setting] new goals…based on inflation,” for instance.

When the simulation didn’t cooperate, due to these flaws, participants would feel frustrated, but would soon learn that setbacks are a part of life, understanding that it takes time “to reach different goals,” says Longoria. Especially in the unpredictable nature of the real world. In fact, “once [students] learn how to use the simulation…they spend more time on it than I ever even assign,” states Strano. He continues to say that students will acquire the concepts of economics to allow money to work for itself. The challenges early on are just to get students to understand the language of the simulation.

This high-tech alternative simulation shifts away from traditional teaching methods such as lectures, PowerPoint, and worksheets. Instead, it introduces a more interactive and immersive way of learning. Longoria states, “I’ve preferred [the simulation] leagues above the paperwork we had to do.” By treating the simulation like a game, students like Longoria and McCauliff find themselves more engaged and motivated, students can “take control of your own little life,” McCauliff notes. The hands-on experience resonates with students who are accustomed to learning through interactive mediums, making the educational process both enjoyable and effective. Because of this, McCauliff and Longoria both agree that Strano and other teachers should continue this for upcoming generations.