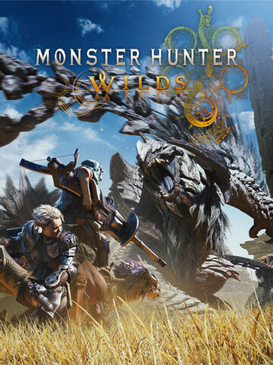

Triple A, or AAA, is a term borrowed from the bond ratings in the credit industry, representing the safest investments. For decades, AAA has been a term that inspired trust in the video game industry. It’s a term that comes from the massive budgets of games franchises crafted by multi-million dollar companies that understood consumer trust came first. They were games that consumers would skip school for, that adults would call in sick for and customers would wait for midnight for.

Now, they are the games customers lament for. Their title, tarnished, laid low by the green of CEOs’ and Board of Directors’ eyes. Each AAA game released today is likely to be another dollop of derivative sludge on the shuddering mountain of gray goo.

According to a report by the CMA (Competition & Markets Authority), the budgets of most AAA games exceed $200 million. This budget is four times what the average AAA budget was only five years ago, around $5-$10 million. Coupling with this rising cost of development is the increase in development time, video graphic technology has advanced far from its 8-bit and rudimentary 3D, reaching levels of detail that rival real life in fidelity. It’s expected that this increase in funding and time would equal games exponentially greater than the last, but unfortunately, that’s not the case.

AAA companies constantly overpromise and underdeliver. Most often, publishers push developers to churn out games quickly, often pushing their employers to their limits with crunch (an insane amount of overtime to finish a project). Thus, the developers burn out and the games come out as a misbegotten abomination that trips over their own sagging form as the public relations teams attempt to gaslight the public that this icon of creative bankruptcy will get better, only after they have consumers’ money.

On top of this, many companies have the audacity to further monetize their half-baked creations. With the rising resource demand for game development, companies have adopted new monetization schemes that would compensate. Live-service, or games as a service, models have become prevalent in the last decade. This model focuses on getting money from consumers through constant, usually weekly, updates that make new items or content available for purchase. This model allowed free-to-play games to generate consistent revenue to fund development and to keep servers up and running assuming the content was commensurate to the price the consumer paid.

Microtransactions, season passes and subscription services are aspects of games to which consumers have grown accustomed. However, this business model has been so successful that it’s tacked onto games that have no business having it, resulting in content that is lazy and often insulting. The model trains people to fear missing out and masks the true cost of in-game items with in-game currencies. Video game companies want to be another bill at the end of the month.

This fall in quality has opened up the market for independent and other smaller game studios to take the spotlight. Games like “Lethal Company,” “Buckshot Roulette” and “Helldivers 2” have done extremely well because they are complete experiences that don’t try to bog consumers down by forcing them to whip out their wallets. “Helldivers 2” is somewhat special in this regard, because while a AAA company and Sony Entertainment published it, Arrowhead Studios has crafted a game that uses the live-service model in a way that is not predatory. Items customers can buy with cash aren’t distinct advantages over base gear, and the in-game is not only fairly priced but obtainable in great amounts by just playing the game. All this exists inside a game for only $40, almost half the market standard of $70.

If the consumers want to steer the industry in the right direction, they need to stop buying games that don’t respect their time from companies that only want to eat into their wages. Customers need to draw this line deeper; backlash is not enough. Most people play games to escape crushing reality by yelling at people over the internet, not so they can fuel consumerism and fund a CEO’s next purchase of a yacht.